All Categories

Featured

Table of Contents

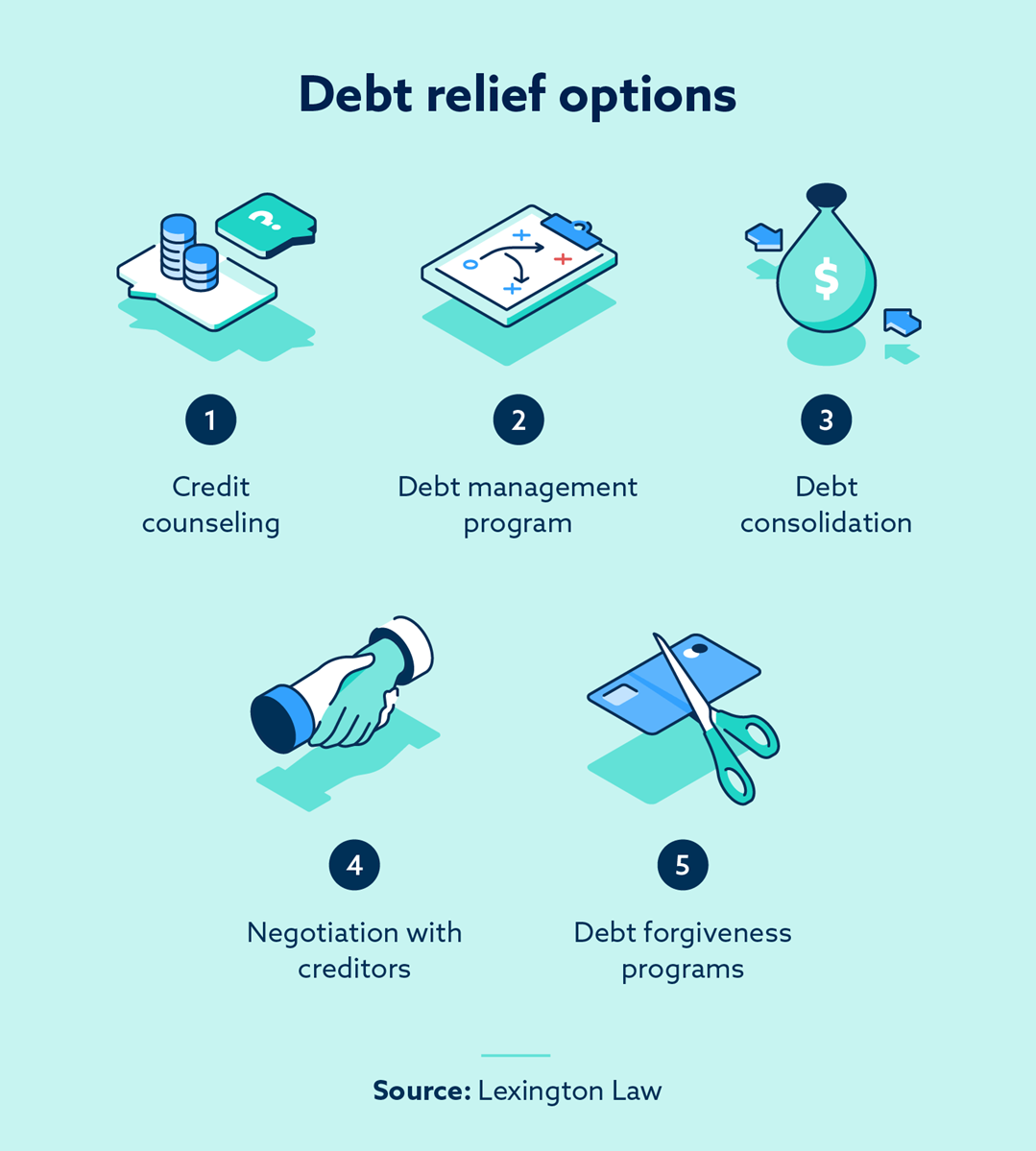

That maximizes cash in the short-term, and you might have 3 to 4 years to save towards the settlement quantity. Very damaging to credit history, mainly as a result of missed payments and an unfavorable "worked out" mark that could remain on your debt record for as much as 7 yearsMay be only alternative if various other options (financial obligation combination, equilibrium transfer charge card, financial obligation forgiveness) aren't possibleTypically calls for a fee to the 3rd party, which might balance out some or all of the financial savings from debt settlementMay assist you prevent bankruptcy if you have actually missed out on a number of paymentsNot all creditors function with financial obligation negotiation firms Financial debt mercy might be ideal for you if you are experiencing an economic hardship that makes it almost impossible to pay for your financial debt equilibriums.

With a DMP, you make one monthly settlement to the credit therapy firm. Those funds are then distributed to financial institutions of your unsafe financial debts, such as bank card and installment fundings. The agency deals with your financial institutions to reduce rate of interest rates or waive costs, however some financial institutions might refuse such giving ins.

A debt combination loan combines your qualified debts into one new finance. It can help you pay for financial debt if you're able to protect a funding rate that's reduced than the typical price of the accounts you're consolidating. You must abstain from racking up financial debt on those recently cleared accounts or your financial obligation might expand also greater.

That gives you plenty of time to eliminate or dramatically decrease your balance while making interest-free repayments.

Little Known Questions About Understanding Your Protections in Debt Forgiveness.

You may require it if your creditor or a debt collector ever before attempts to accumulate on the financial obligation in the future. The letter can show you do not owe what the debt collection agency's records reveal. Yes, in many cases, the internal revenue service thinks about forgiven debt as gross income. When a lender forgives $600 or even more, they are called for to send you Type 1099-C.

Debt mercy or settlement generally harms your credit report. Anytime you resolve a financial obligation for much less than you owe, it might look like "cleared up" on your credit history record and affect your credit rating for 7 years from the date of negotiation. Your credit scores can additionally drop significantly in the months causing the mercy if you fall back on payments.

What Does Types of Debt Forgiveness You May Know About Mean?

Tax obligation financial obligation concession programs Tax debt happens when the quantity of tax obligations you owe surpasses what you have actually paid. This circumstance usually arises from underreporting income, not filing returns on time, or inconsistencies located during an IRS audit. The effects of building up tax obligation financial obligation are serious and can include tax liens, which give the internal revenue service a lawful claim to your home as safety for the debt.

Incomes and Financial institution Accounts Internal revenue service can impose (take) earnings and bank accounts to satisfy the debt. Residential property Seizure In severe situations, the IRS can seize and sell building to cover the financial debt.

Social Stigma Dealing with lawful action from the IRS can lug social preconception. Employment Opportunities A poor credit history score due to strain financial obligation can limit employment possibilities. Government Advantages Tax financial debt might impact eligibility for government benefits, such as Social Security and Medicaid.

All about Preventing Future Debt Problems After Debt Relief

The OIC takes into consideration a number of variables, consisting of the taxpayer's earnings, costs, property equity, and ability to pay. Efficiently discussing an OIC can be intricate, needing a detailed understanding of the internal revenue service's guidelines and a strong disagreement for why your offer straightens with your capability to pay. It is essential to note that not all applications are accepted, and the process calls for comprehensive economic disclosure.

The internal revenue service evaluates your general economic situation, including your revenue, costs, asset equity, and capability to pay. You have to likewise be current with all declaring and settlement demands and not remain in an open insolvency case. The IRS likewise considers your compliance background, examining whether you have a document of timely filing and paying taxes in previous years.

The Main Principles Of Digital Tools Makes What to Do When You Can't Pay Your Income Taxes: A Complete Financial Recovery Guide : APFSC Easier

The application process for an Offer in Concession includes a number of in-depth steps. Initially, you should complete and submit internal revenue service Kind 656, the Deal in Concession application, and Kind 433-A (OIC), a collection info declaration for individuals. These kinds require extensive financial information, consisting of details about your income, financial obligations, expenditures, and possessions.

Back tax obligations, which are overdue tax obligations from previous years, can significantly enhance your total IRS financial debt otherwise addressed promptly. This financial debt can accrue rate of interest and late settlement charges, making the initial amount owed much larger gradually. Failing to repay taxes can lead to the IRS taking enforcement activities, such as releasing a tax lien or levy versus your residential property.

It is essential to attend to back taxes asap, either by paying the total owed or by preparing a layaway plan with the internal revenue service. By taking positive actions, you can stay clear of the build-up of extra rate of interest and fines, and avoid a lot more aggressive collection activities by the IRS.

One common reason is the idea that the taxpayer can pay the complete amount either as a round figure or via a layaway plan. The IRS also considers the taxpayer's revenue, expenditures, possession equity, and future earning potential. If these factors suggest that the taxpayer can pay for to pay more than the offered amount, the IRS is likely to decline the deal.

The smart Trick of Real Stories from Bankruptcy Counseling Recipients That Nobody is Discussing

It is crucial to offer precise and complete information in your application and to speak with a tax obligation professional to boost the opportunities of acceptance. Dealing with IRS financial debt can be complex and daunting. Tax experts, such as CPAs, tax lawyers, or enlisted representatives, can provide important help. They have the experience to navigate the ins and outs of tax obligation law and internal revenue service treatments.

Table of Contents

Latest Posts

"Financial counseling for veterans in Texas who are overwhelmed by credit card debt Ruins Your Credit" and More Lies - The Facts

More About Industry Changes for How to Use Credit Cards Wisely to Avoid Debt : APFSC and Debtor Options

Additional Charges That Reputable Providers Don't Have Things To Know Before You Buy

More

Latest Posts

"Financial counseling for veterans in Texas who are overwhelmed by credit card debt Ruins Your Credit" and More Lies - The Facts

More About Industry Changes for How to Use Credit Cards Wisely to Avoid Debt : APFSC and Debtor Options

Additional Charges That Reputable Providers Don't Have Things To Know Before You Buy